ad valorem property tax florida

Ad Valorem Taxes The Ad Valorem tax roll consists of. HOMES FOR THE AGED.

Tax Prorations Explained For Florida Real Estate Closings Part 2

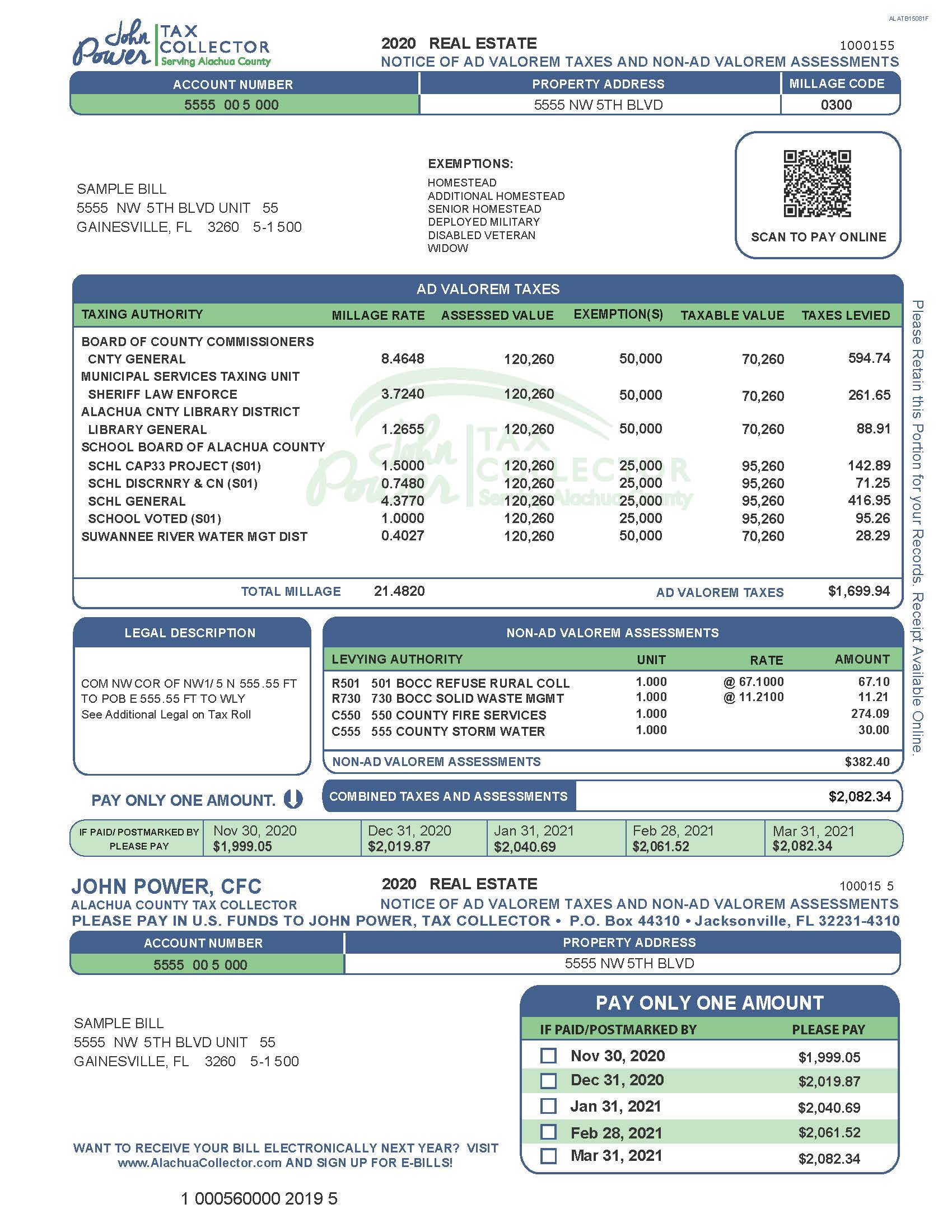

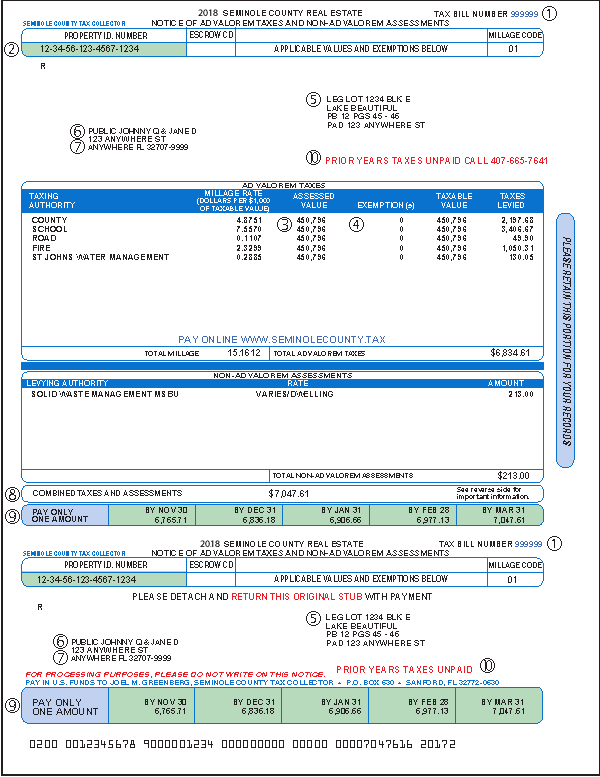

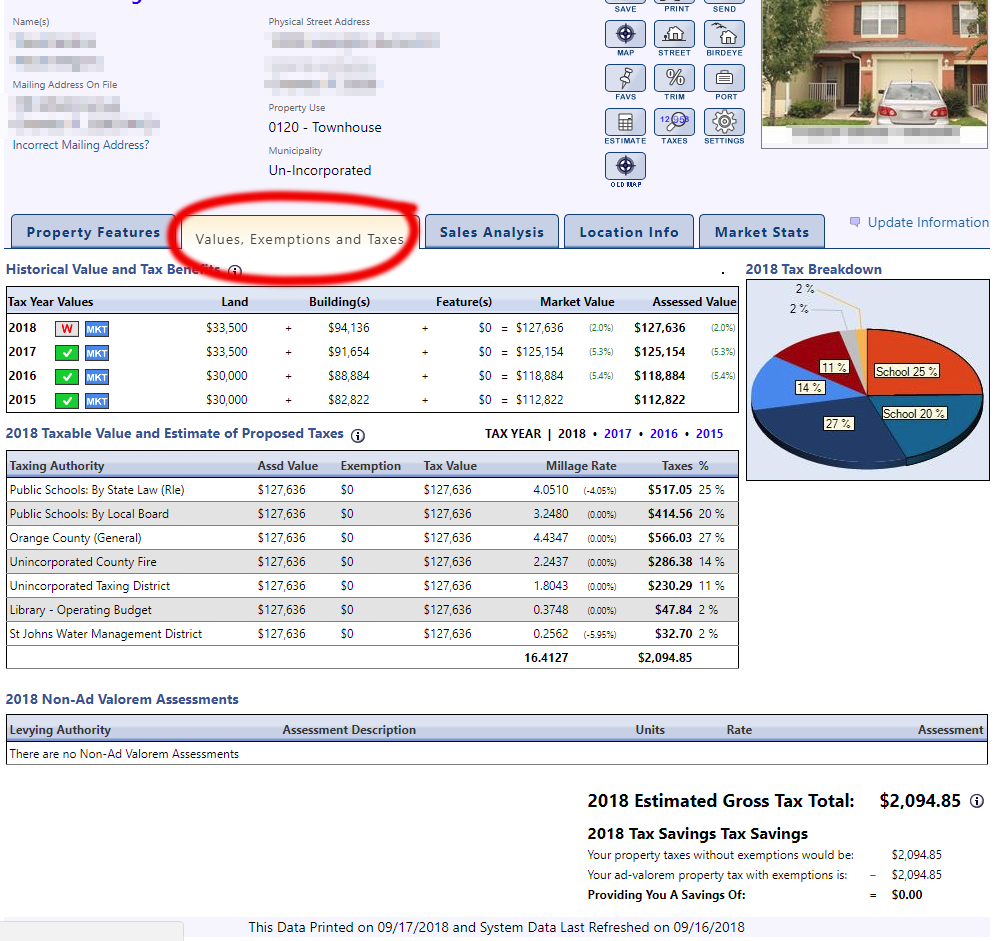

The Real Estate Tax Notice is a combined notice of Ad Valorem Taxes and Non-Ad Valorem Assessments.

. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. Copies of the non-ad valorem tax roll and summary report are due December 15. 10 Mill means one onethousandth of a - United States dollar.

Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. Tangible Personal Property Taxes are an ad valorem tax assessed against furniture fixtures and equipment located in businesses and rental property. 1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments.

Ad Valorem Taxes Real property is located in described geographic areas designated as parcels. Learn more about Tangible Property Taxes Delinquent Taxes Taxes and assessments are due November 1 and are delinquent April 1. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Florida Administrative Code. FLORIDA COMMUNITY LAND TRUST INSTITUTE PRIMER A PUBLICATION OF THE FLORIDA HOUSING COALITION 62. The tax is levied on the assessed value of the property which by law is.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. It includes land building fixtures and improvements to the land. Based on the assessed value of property.

Under the provisions of Section 193621 Florida Statutes FS and Chapter 62-8 Florida Administrative Code some types of air or water pollution control equipment installed at any manufacturing or industrial plant may be eligible for decreased assessment value for ad valorem tax purposes. 1299 section 1961995 FS PDF 446 KB DR-418C. It includes land building fixtures and improvements to the land.

If a county property appraiser is in doubt whether a taxpayer is entitled. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. Ad valorem means based on value.

Body authorized by law to impose ad valorem taxes. Uniform throughout the jurisdiction. Ad valorem ie according to value taxes are.

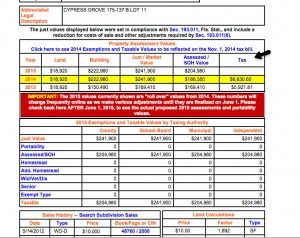

Taxes usually increase along with the assessments subject to certain exemptions. Often called property taxes Non-ad valorem Assessments. Ad Valorem taxes are based on the property value less any exemptions granted multiplied by the applicable millage rate.

Santa Rosa County property taxes provide the fund local governments to provide needed services such as education law. The sovereign right of local governments to raise public money. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Ocala Florida 34471 Phone. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. Millage may apply to a single levy of taxes or to the cumulative of all levies.

1 The Board of County Commissioners or. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. 4 if paid in November 3 if paid in December 2 if paid in January 1 if paid in February.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. 11 Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows. If a Florida Property Tax Appraiser denies your longstanding ad valorem tax exemption you may be able to get it back by challenging the denial in front of the Value Adjustment Board or in circuit court.

The Property Appraiser establishes the taxable value of real estate property. These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements.

The collection of taxes as well as the assessment is in. Economic Development Ad Valorem Property Tax Exemption R. Ad Valorem Taxes Real property is located in described geographic areas designated as parcels.

On the tax roll. They are levied annually. In accordance with 2017-21 Laws of Florida 119 Florida Statutes.

A millage rate is one tenth of one percent which equates to 1 in taxes for every 1000 in home value. Non-ad valorem tax rolls are prepared by local governments and are certified to the tax collectors office for collection. Ad Valorem Taxes are taxes levied on real property and calculated using the property value and approved millage rates.

TAX COLLECTIONS SALES AND LIENS. Railroad taxes Real estate taxes Tangible personal property taxes Property Assessment The property appraiser assesses the value of a property and the Board of County Commissioners and other levying bodies set the millage rates. Taxes are normally payable beginning November 1 of that year.

A lien against property. According to Florida Statute 197122 all property owners have the responsibility to know the amount of tax. Floridas ad valorem statute allows tax exempt entities to be exempt from real property taxes when the property they own is being used to provide affordable rental housing as affordable housing is a charitable use.

The tax roll describes each non-ad valorem assessment included on the property tax notice. The greater the value the higher the assessment. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions.

Using these figures the property appraiser prepares the tax roll. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. PDF 106 KB Individual and Family Exemptions Taxpayer Guides.

Florida property taxes are relatively unique because. It also applies to structural additions to mobiles homes. A Levy means the imposition of a non-ad valorem assessment stated in terms of rates against all appropriately located property by a.

Ad valorem tax florida ballot Wednesday February 16 2022 Edit. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. Florida property taxes are relatively unique because.

The March decision sides in favor of the former property appraiser ultimately ruling that the golf courses property was not ad valorem. Non-ad valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. Section 1961995 Florida Statutes requires that a referendum be held if.

1 As used in this section. The most common ad valorem taxes are property taxes levied on real estate.

An Investment In Knowledge Always Pays The Best Interest Floridatitlecompany Realestateattorney Www Marinatitle Com Investing Estate Lawyer Real Estate

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law

A Guide To Your Property Tax Bill Alachua County Tax Collector

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

Broward County Property Taxes What You May Not Know

Form Dr 504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Charter School Facilities Florida Templateroller

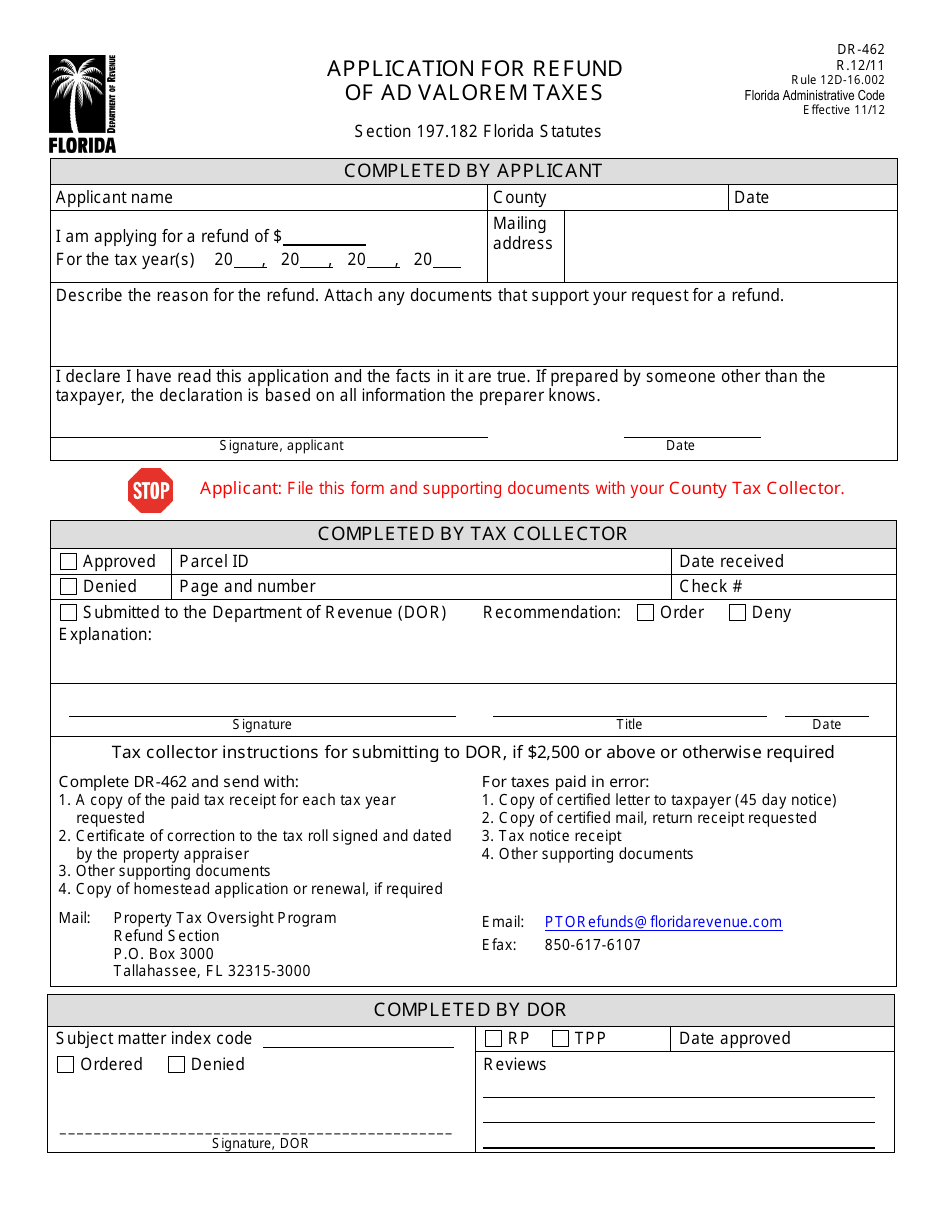

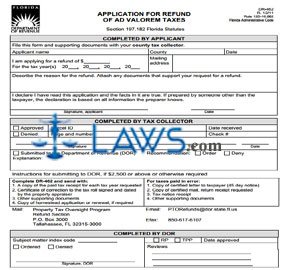

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

Real Estate Property Tax Constitutional Tax Collector

Understanding Your Tax Bill Seminole County Tax Collector

Property Tax Page Bluehome Property Management

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Understanding Your Tax Notice Highlands County Tax Collector

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Real Estate Taxes City Of Palm Coast Florida

Time Is Running Out To Pay Your Property Taxes No Worries Stop By Avb Bank S Downtown Broken Arrow Location 322 S Main St Thi County Property Tax Bank

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc